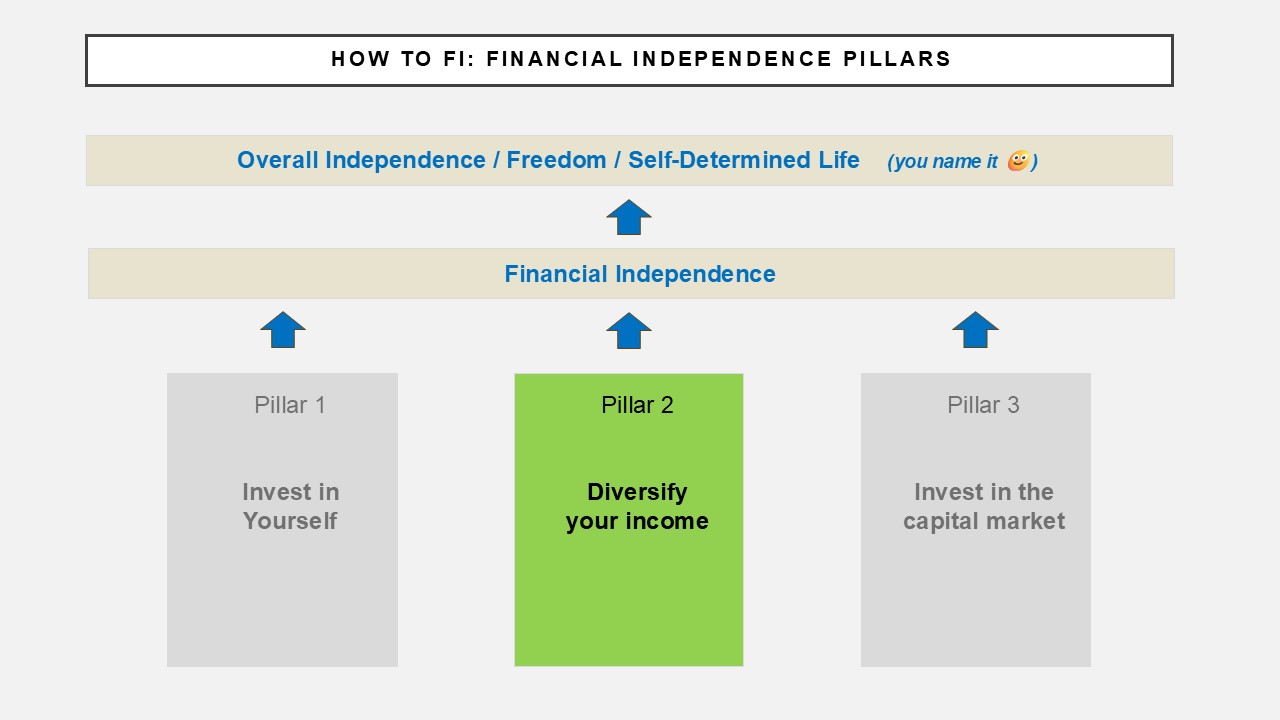

How to FI: Diversify your income streams, lower your costs

Today, let’s deal with the second pillar of financial independence:

It’s about earning more money in absolute terms while at the same time lowering your costs to a reasonable extent.

1) Earning more money in absolute terms

Just my personal point of view: I think it’s essentially important not to rely just on one single source of income.

Because in that case you make yourself too dependent. And you will face serious problems, should your only source of income break away.

That’s why I think you should open up to the long-term goal of creating additional sources of income – and as a consequence, increasing your income in absolute numbers.

Although I am writing primarily about the third pillar (financial topics and investing) in my blog, I personally think the second pillar is not to be underestimated!

Obviously, every source of income is subject to certain monetary fluctuations – whether it’s labour/business income, dividend income or rental income.

But if you manage to build up several parallel streams of income, you don’t have to worry about a financial low if a source of income stagnates or even breaks away completely.

Just to give you some food for thought: What (combination of) possibilities for additional sources of income are being worth considering? I hereby distinguish between 1:1 and 1:n activities.

1:1 = You trade time for money and can serve only one customer at a time

1:n = You serve many customers via decoupling your time spent from money

Here is a small selection (not exhaustive):

➡️ Assuming you exercise your main professional activity which is a 1:1 activity.

What about creating an additional income source which is based on 1:n? Just as a simle example: You work as a marketing freelancer (1:1), and you could additionally teach marketing via creating digital online course products (1:n).

➡️ Or vice versa: you exercise your main professional activity as a 1:n.

So why not creating an additional income source which is based on 1:1? Example: You have an online shop, and you assume a seconday activity as business coach.

➡️ You could also combine two activities of the same kind together.

For example a 2 x 1:1 combination (let’s say, you work part-time for a company as well as on your own as a graphic design freelancer). Or you go for a 2 x 1:n combination (let’s say, you sell digital online course products and operate an online shop business).

➡️ You could also combine your initial 1:1 or 1:n activity with a small (full- or part-time) side hustle.

Example: You work as an IT consultant or create templates to be sold – and you combine either of both activities with a little side hustle, like dogwalking or e-commerce reselling or participating in market research surveys.

You see: In today’s world, there are so many opportunities to combine several kinds of work.

But let’s be realistic: It takes a lot of time, effort and energy to create additional professional income sources.

Yet I would encourage everyone to adapt following philosophy: Look out for professional activities in which you can provide added value for customers AND which give you lots of fulfillment. In the ideal case, your professional activities match your passions.

Creating multiple income streams leads to: Raising your income. The more you earn, the more you can invest (pillar 3). Especially if you are at the beginning of your financial independence journey, I personally would make sure to put a bit more emphasis on pillar 2.

With more years passing by, your invested money will work for you (pillar 3).

2) Lower your costs – to a reasonable extent

If you are striving for financial independence, I personally think you should not spend your money on things that you don’t need, respectively that you cannot afford.

This can be observed over and over again, especially among people with a high income. This is also called “lifestyle inflation”: People buy expensive furniture, live in oversized apartments that they bought on credit, and an expensive car (being paid in installments) is also a must as a status symbol, of course 😊

But all these things have one thing in common: they are utility goods which wear out over time until they eventually only have scrap value. Yes, really great status symbols…

And what happens if your income – or your only source of income – breaks off as a result of unemployment or slack demand? How are you going to pay your bills and loans? The people concerned usually cannot give a satisfactory answer to this question…

Don’t get me wrong. I’m not in the position to tell other people what they should spend their money on. This is just to raise awareness that overly consumption can hinder your financial wealth creation process.

So I think the rule should be: Raise your income side by diversifying your professional activities – which goes hand in hand with several income streams. At the same time, you reduce your expenses to a reasonable extent (its level is always subjective, of course).

By raising your income side and reducing your expenses, you will have more disposable income at hand. Now here the rule is: Pay yourself first!

This means: After you receive your income on your account, you take stock at the end of the month. And then, you immediately put aside a certain amount of money at the beginning of the following month, which you use to invest. This is a procedure which you will have to automate month by month.

As a result, you are not even tempted to spend your money on unnecessary things. Again, your income must always be bigger than your expenses.

Believe me: Especially at the beginning of your work career, it definitely takes a lot of effort to getting used to regularly putting aside a certain part of your income, although the temptation to spend your money on this or that is often given.

But keep in mind that in the long run you will be rewarded for your savings and investment efforts. The compound interest rate will work for you in the long run.

Now the question is: What percentage of your net income should you save?

If it’s feasable, I recommend starting with saving at least 10% of your net income at the beginning of your career. Of course, you should gradually go for a higher percentage in the course of time. And this should be possible if you have additional professional activities that generate income as well.

What is a proper savings rate? Well, I think there is no general rule since individual situations are different. But as a point of orientation, I would recommend a savings rate of at least 30% or (preferably) more as a long-term goal.

But I honestly have to admit that not many people can achieve this in practice, especially if they have families. But nevertheless it should be in the DNA of everyone to regularly save and to increase the savings rate in the course of time.