Stock market investing: Your wealth creation booster

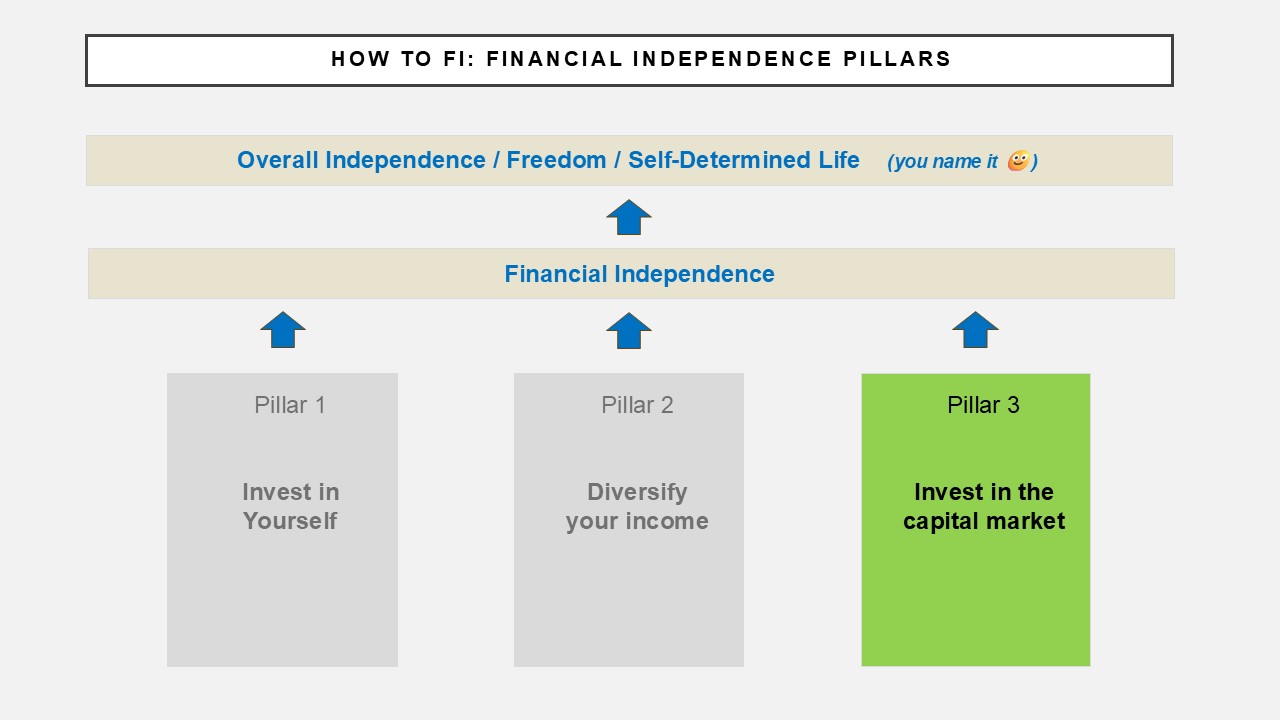

Today, let’s deal with the third pillar: Investing

As I have previously stated:

💡 Imho, the foundation of wealth creation is based on your income.

Respectively, on raising your income via creating more than one income stream.

💡 Subsequently investing a larger part of your income in the stock market accelerates your wealth creation – significantly!

If you feel not skilled enough yet to focus on single stock picking, you have the freedom to invest in ETFs (Exchange Traded Funds) that offer “baskets” of international companies of different sectors and regions.

Whether you invest in single stocks or in ETFs: You have plenty of options to diversify your investments in order to reduce your default risks.

1) Why should you invest in stocks?

I personally prefer stocks to other asset classes for following reasons (the list is non-exhaustive, of course… but just to give you some of the most important reasons):

a) A “value creating” asset class

Stocks are a “value creating” asset class. I.e. you invest in companies whose genuine nature is to create value with their products/services to their target customers.

In doing so, companies generate profits that result in income – in the form of labour or capital income. The performance of any other asset classes (like real estate or commodities) is to some extent dependent on this value-creating category.

Rents, property prices and the cost of gold or oil investments can only be paid to the extent that this is made possible by the profit generated by companies. This generates the capital that is available for other forms of investment.

Therefore, by investing in companies, you are directly involved in the source of value creation. If you also own shares in these companies, you can rightly expect approproate returns.

b) An asset class with comparably (!) high returns – perfect for long-term investing

Of all forms of investment, stocks have historically achieved the highest returns.

Example: Upon establishment, the S&P 500 index (which comprises the 500 largest listed US companies) was quoted at around 44 points.

Today, the S&P 500 is trading at almost 70 times the initial level. Based on historical analyses, the long-term average return for stocks, including dividends, is between 7 % and 9 % per annum. Caveat: NOT guaranteed in the future, of course!

BUT: Of course, returns go along with risks. Which means: The higher the return, the higher the risk. Stock price fluctuations are normal. So are (temporary) price losses – even if a company has a robust business model and solvency.

But if you have a long-term investment horizon of 30+ years (which I strongly encourage everyone to go for), then you don’t have to worry about temporary losses at the stock market.

You will see your capital grow steadily over time. Provided that you do your homework first and choose only (and only) high quality companies to invest in.

c) Benefit from a company’s success – as a shareholder

Generally speaking, investing in stocks is also about the idea of collective ownership of businesses – and that’s what makes investing very exciting!

Especially investors with smaller capital have the opportunity to become shareholders in companies.

As a shareholder, you can exercise your ownership rights (such as co-determination) at the Annual General Meeting. And there is a right to a share in the profits.

As a company shareholder, you can benefit twice from a company’s corporate success:

- Firstly, via a (usually) rising stock price on a long-term basis (BUT: The same applies vice versa. Falling stock prices can happen as well, if things go badly for the company. Please keep that in mind).

- Secondly, via distribution of profits to their shareholders in the form of dividends (BUT: The same applies vice versa. Dividend cuts can happen as well, if things go badly for the company. Please keep that in mind).

d) Large selection options – worldwide

The stock market offers the opportunity for investors to invest in a variety of companies of different sizes, geographical regions and business sectors.

If you invest in single stocks, you can tailor your investments by focusing on very specific regions and segments. You can choose among thousands of listed companies from all over the world.

e) Flexible way of buying and selling

Unlike other asset classes (like physical real estate, for instance), stocks can be traded very flexibly at the current market price.

Leaving rare exceptions such as trading suspensions aside, the stock exchange ensures that there is always a market price at which a stock can be bought and sold.

Stocks are therefore a suitable liquid vehicle for long-term investments (well, and also short-term trading as well… but I’m not into that at all 😊).

But vice versa, this flexibility becomes also relevant if you think that the company you invest in, no longer fulfills your investment expectations.

f) Reducing your risk through diversification

When compiling your investment portfolio, you have the freedom to diversify your stocks across several companies and sectors at the same time.

This in order to reduce the risk so that you don’t depend on a specific industry sector or geographic region.

However, diversification as such shouldn’t be too overrated! Having 50 stocks in your portfolio, is way too much.

Also interesting know that you can apply a certain concentration within diversification, i.e. you take the broad investment universe as a basis, but then you select a majority of stocks within a concentrated area of this universe. For instance, within your diversification, you have a concentrated focus on non-cyclical stocks and growth/tech stocks as an add-on.

g) Benefiting from new trends

With an investment in stocks, you can also benefit from new trends – whether it’s a new technology or sector or commodity.

However, this requires a thorough research beforehand and a good sense for trends. If you recognize a trend at an early stage before the broad mass of investors, you can benefit from upward movements of that respective stock.

However, I would recommend not to focus entirely on trendy stocks, but to focus broadly on companies with a proven solid business model.

2) What’s the flip side to that coin?

Well, there is no such a thing like a “safe” investment. Every asset class (not only stocks, but also real estate, bonds, commodities, etc.) has its risks.

a) Risk of (total) loss

For single stocks, in rare cases a total loss is also possible if business develops negatively.

In that case, an insolvency of a public limited company usually means that the shareholders as owners are left empty-handed (Enron, Lehman Brothers, Wirecard… you name it).

b) Enormous stock price fluctuations

Stock prices are sometimes subject to enormous fluctuations. This can happen in various scenarios:

- Market risks: In temporary bear markets or crashes, stocks can temporarily lose an average of 20, 30, 40 or 50% or even more in value.

- Business risks: A company’s business may not perform well, e.g. due to management failure, solvency issues, missing technological disruptions or a supply shortage of raw materials.

Furthermore, bad company news outside trading hours, for example, can lead to downward price gaps, i.e. a large gap between the last market price of the previous day and the opening price of the following day.

c) Risk of buying when overpriced

When investing in a specific single stock, you must ensure to buy it during a time frame when it’s “undervalued”, e.g. when the stock price is below its so-called “fair value”. This requires a thorough financial analysis beforehand!

If you invest at an unfavorable point in time, you may have to wait several years until your initial losses have been recovered and a worthwhile return is achieved (this applies even in the case of top quality stocks).

If you need liquidity at an unfavorable time, you may be forced to sell at low prices during a stock market correction period.

d) Risk of trading suspension

If the stock exchange’s supervisory authority discovers irregularities in the trading of a stock, its trading may be (temporarily) suspended.

This period of time during which the stock cannot be traded, can range from a few minutes or several days/weeks to a permanent suspension.

However, the latter is very rare, and it usually concerns only bankrupt companies.

But there a also positive cases of a trading suspension, e.g. before a company takeover bid.

3) Will the stock market make you “rich”?

Now that I have spent so much time to advocate investing in stocks, the question is: Will stocks make you rich?

My personal answer (which might surprise you): “It depends on the scenario.”

Let me now explain why I see it that way.

As I have stated in my PREVIOUS ARTICLE:

Imho, raising your income and making more money in absolute numbers matters relatively more than achieving the best percentage return!

➡️ Raising your income in absolute numbers = basis for long-term wealth creation.

➡️ Investing your money and achieving attractive annual percentage returns = booster for long-term wealth creation.

Let’s have a look at income in absolute numbers and percentage returns from different perspectives.

Let’s have a look at these four scenarios. Which of these do you consider a very realistic one?

Scenario 1: monthly 200 USD savings plan, 9% return, investment horizon 30+ years

Scenario 2: monthly 200 USD savings plan, 23% return, investment horizon 30+ years

Scenario 3: monthly 2.000 USD savings plan, 9% return, investment horizon 30+ years

Scenario 4: monthly 2.000 USD savings plan, 23% return, investment horizon 30+ years

Yes, scenario 1.

If you generate a solid income from your profession, saving 200 USD per month for investing should serve as a minimum guideline value (to be steadily increased in the long run, of course).

This in combination with generating an annual average return of 9% over a 30+ years period is a realistic scenario – and should be feasible for everyone.

Now what’s wrong with Scenarios 2 and 4?

Yes, the returns 😊 I’m sure that generating 23% on average per year is very tempting for everyone, right?

Well, I previously have said that higher returns go along with higher risks. I personally don’t know anyone who has been generating a 23% return for 30 years with investing in high quality stocks.

Furthermore, it’s nearly impossible to generate such high returns year by year – unless you have a random shot of big luck or invest in highly speculative stocks. But that’s NOT my philosophy.

So what about Scenario 3?

I personally would recommend everyone to make Scenario 3 become a realistic one.

Many people are dealing with relatively small amounts. In this context, it doesn’t matter whether you make a 9 or 23% return: With such small amounts of capital invested, your capital gains in absolute numbers will be low.

Obviously, investing 2,000 USD per month is not feasible for many people, especially at the beginning of their wealth creation journey. But as I said in my previous article: Make your earnings in absolute numbers form the basis for your wealth creation journey – and try to raise your investment contribution steadily.

Attractive absolute returns are only possible if you invest larger sums of money (and I mean at least 4-figure amounts per month).

To conclude with a remark on returns:

If you invest in the global stock markets (for example via ETFs), you can expect an average annual return of 7-9% (let’s make it 8%). You don’t even need to do much research.

If you invest in single stocks of high quality (!) companies, it is possible to outperform the market and to generate average annual returns of 11, 12, 13% or even more, based on several decades).

4) The power of compound interest rate – not to be underestimated!

Now that we have seen that constantly generating very high returns every year is nearly impossible: What are the key ingredients to boost your financial wealth creation process?

We have already talked about following ingredients:

➡️ Investing more money in absolute terms

➡️ A solid and realistic return

➡️ … and there is a third component missing: TIME

This is where the so-called “compound interest rate” comes into play.

Just a brief exemple: You all know Warren Buffett – the master of value investing.

Fact 1: He generated 97% of his currently 96 trillion USD after his 65th birthday.

Fact 2: He has been investing since his early teenage days.

Now being in his personal 90s, Warren Buffet can surely look back and say: Time was my best supporter.

Let’s recap our previous Scenario 3: monthly 2,000 USD savings plan, 8% return, 30 year time horizon.

Let’s take a look at a few 5-year periods. Between the 5th and 10th year of investment, your wealth would increase by just over USD 200,000. Between the 15th and 20th year, your assets would increase by just under USD 500,000. And between the 25th and 30th year, your assets would even increase by USD 1,000,000!

These are doublings – in the same 5 years periods of time. And this is simply due to the compound interest effect.

Due to the effect of compound interest when saving and investing, the value of your investment grows disproportionately (instead of linearly) over the long term.

The higher the interest rate and the longer the investment period, the greater the effect of compound interest.

As you can see from the graph, this process is somewhat slow at the beginning. But as the years go by, compound interest takes effect… and towards the end of the 30-year example period, there is an explosion in asset growth 😊

However, compound interest has a potential obstacle: Ourselves.

On the path to long-term wealth accumulation, we might run the risk of getting in our own way. For example, if we are impatient, lose the desire to invest consistently or invest without a clear strategy.

I can therefore only appeal to you: Cultivate your discipline, your time, your skills and your money-making qualities 🙂

IV. Conclusion

The stock market is one of the most exciting and rewarding ways to accelerate your financial wealth creation journey – for financial independence and old-age provisison.

Whether you invest in ETFs or single stocks: Good, even above-average returns are possible.

Ahead of investing: Always educate yourself and get an understanding of what you are buying. Yes, in case of single stocks, you need to do a thorough analysis homework beforehand.

However, you should be aware that there is no guarantee of success and that temporary losses are also possible.

You should therefore only invest capital that you are prepared to lose.

Combine investing with the process of acquiring knowledge. At the same time, don’t take irresponsible risks or make irrational decisions based on emotional stimuli!