The discussion about ETFs vs. single stocks is one of the most popular debates in the investment world.

Never miss a good story!

Subscribe to my newsletter to keep up with the latest insights!

In a nutshell:

What

For

How

Goal

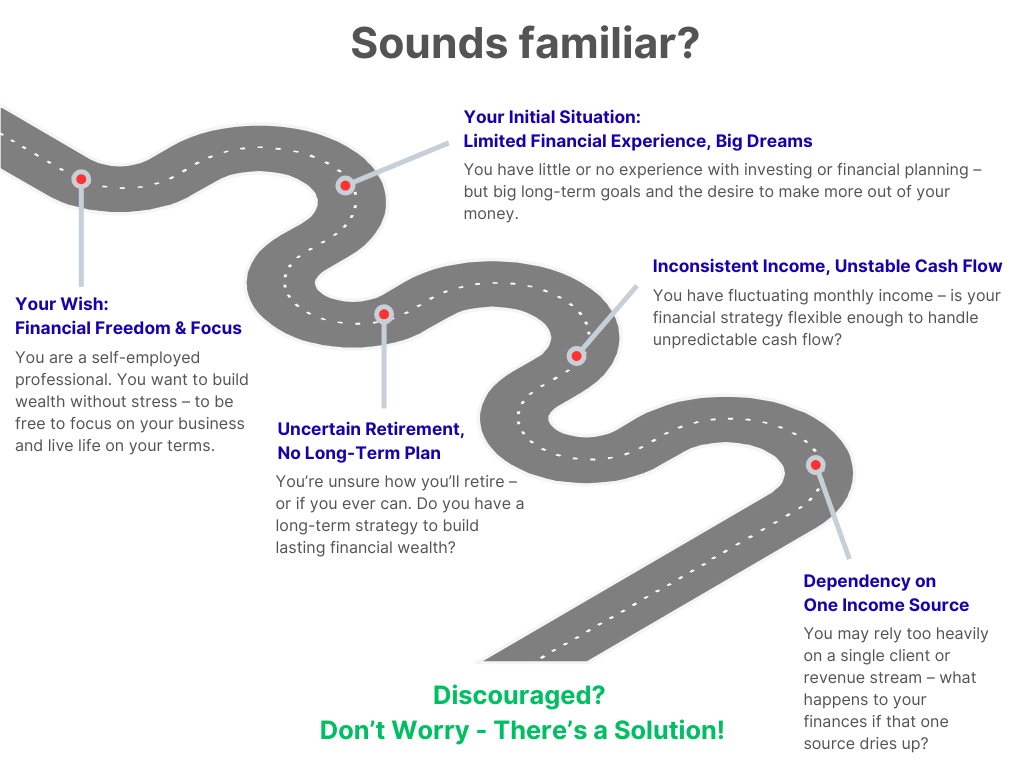

In my Academy, you'll gain the essential knowledge and proven strategies to confidently build long-term financial wealth - step by step, even if you're starting from scratch. So you can enjoy financial peace of mind and focus on your life goals.

In the world of finance, a positive "alpha" (α) refers to investment returns that outperform the average market return.

That's what 365 Alpha Academy is all about: helping you outperform your current financial status and become the Alpha of your own financial life.

With the right investment knowledge, you can leave your current status quo behind. You'll empower yourself to make smarter money decisions and take control of your financial future. Every single day.

"My personal guidance. Our joint implementation."

My financial journey led me from studying Economics straight into a 14-year career in European financial markets regulation – with a focus on financial education, pensions, investment funds, and corporate governance.

Along the way, I gained 10+ years of hands-on experience as a private retail investor in the stock market.

In 2022, I took the leap and started my own venture: With 365 Alpha Academy, I've been supporting self-employed professionals in building their own sustainable wealth creation process – first offline, now online.

Because I believe that building multiple sources of income is essential for wealth creation, I've developed a second professional path as a Freelancer in SEO and Online Marketing alongside my work in investment education.

Today, I focus on creating diverse income streams and strategically investing a significant portion of them in the stock market. This is how I build my own financial independence – and I'm passionate about sharing my investment and portfolio strategies in a hands-on and practical way.

Want to discover my "recipe" for independent and empowered finances? Let me show you how!

testimonials

Trees R.

These 2 testimonials are just after you’ve introduced your business, so they should focus on how great the products are and why they are worth trusting.

Konstantin W.

These 2 testimonials are just after you’ve introduced your business, so they should focus on how great the products are and why they are worth trusting.

Christian T.

These 2 testimonials are just after you’ve introduced your business, so they should focus on how great the products are and why they are worth trusting.

Patricia S.

These 2 testimonials are just after you’ve introduced your business, so they should focus on how great the products are and why they are worth trusting.

Download now

You don't have a clear investment plan in mind?

You tend to make your investments based on emotions?

Find out more about these and other mistakes and learn how to avoid them.

Never miss a good story!

Subscribe to my newsletter to keep up with the latest insights!